Web Desk

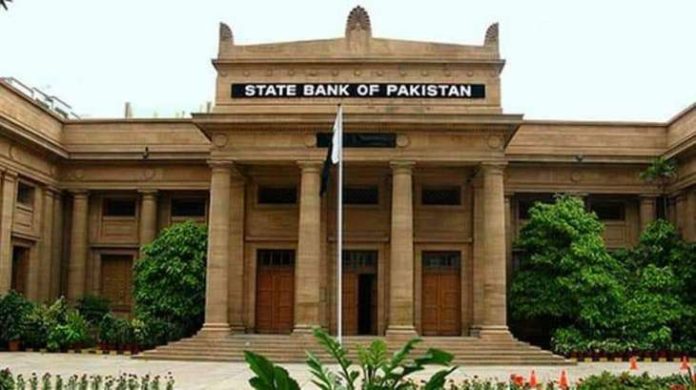

All short-term indicators show that the stabilisation phase has ended and Pakistan’s economy is now “firmly in the growth stage, said Governor State Bank of Pakistan Dr Reza Baqir said on Friday.

“Pakistan’s economy has fully completed the phase of stabilisation in the last two and a half years; The country shows the international community that it controlled two reasons for problems — current account deficit and fiscal deficit,” he told a news conference in the capital, Islamabad.

He recalled that two years ago, discussions were focused on economic recession and the low GDP growth. “Three months ago, you were saying GDP growth would be two per cent in the last [fiscal] year. [But] the estimate was 4pc. The estimate this year is of 4-5pc growth.”

“After stabilisation, [Pakistan’s economy] shifted towards growth and the proof is in front of you in the form of 4pc growth. All short-term indicators — auto sales, cement sales, electricity consumption and fast-moving consumer goods — are showing that we are firmly in the stage of growth.”

The SBP governor said it should be appreciated that there was no talk about an economic recession now, instead the conversations revolved around the improving economy.

He said that Pakistan’s net international reserves — the figure for which was very important because short-term debts were subtracted from it — would rise because of the new special drawing rights (SDR) allocation by the International Monetary Fund (IMF).

“Our reserves should come to historical highs,” he predicted.

About Current Account Deficit, Dr. Baqir said that the current account deficit (CAD) figures for May and June were high which had led a lot of journalists and analysts to question whether it was increasing very rapidly.

Giving the State Bank’s views on the matter, he recalled that the central bank had said in its monetary policy issued last month that the current account deficit would be between two and three per cent of the GDP in this fiscal year.

“This roughly translates to a current account deficit of $6.5-9.5 billion for this year. First, it is a sustainable level of current account deficit according to our assessment,” he said explaining that a “moderate level” of CAD was “good news” for emerging markets.

He said international experience showed there were three alarm bells that “caused worry”, adding that not even one of those alarm bells were ringing in Pakistan’s case.

“We faced difficulty in the past when our current account deficit reached 6pc of GDP and after that, our reserves losses were [so great] that we had to go to the IMF.”

The first alarm bell was when the current account deficit was increasing very fast, he said while the second alarm bell was if the exchange rate was not adjusting to the current account deficit.

“It is a natural phenomenon that if your outflows are more, imports are rising and exports are not increasing, then the exchange rate should adjust. If the exchange rate in a market-based country is showing a good two-way adjustment as in the case with Pakistan, then it is a positive indicator.”

The third alarm bell was a massive decrease in reserves, he said. The opposite was happening in Pakistan, however, the SBP governor added.

“Our conditions today are on the opposite end of these three points. Our reserves are at $18bn [and] our exchange rate is adjusting in an orderly way.”

Responding to a question, the SBP governor said that Pakistan had gone through a boom-bust cycle in the past — an indicator of unsustainable growth — because of which the country had to approach the IMF more than 20 times.

“We should discuss how to keep the growth sustainable this time around. Our last year’s growth and estimates for this year’s growth are sustainable.”

He said that some factors which had prevented the growth from being sustainable in the past were also absent now and credited the market-based exchange rate system for the prevention of a rapid increase in current account deficit.

Secondly, the reserves and net international reserves had been increased, he said, adding that the IMF had acknowledged in its reports that “Pakistan has shown overperformance of billions of dollars in its international net reserves”.

“I can say with full assurance that the primary objective of the economic team of this country is to keep this growth sustainable,” he stressed.

He noted that the debt-to-GDP ratio had increased by up to 10pc in developing countries in 2020 as compared to 2019 but Pakistan had instead managed to decrease its debt-to-GDP ratio.

“We expect that the market will also get confidence that despite Covid, we did not let the economic fundamentals deteriorate.”

Talking about the impact of the coronavirus on Pakistan’s economy, he said that the World Bank had “openly said” that Ehsaas was the world’s third or fourth-largest such programme. “We should be very happy about this recognition at the international level.

“If you see the experience of other countries regarding Covid, if you look at big emerging markets like Brazil and India, you will see that Pakistan is among the very few countries that controlled the wave of Covid many times,” he added.