By Muhammad Luqman

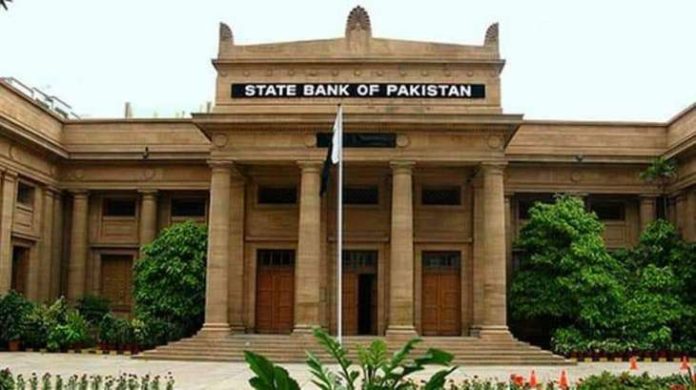

The State Bank of Pakistan has increased its benchmark interest rate by 150 basis points to 12.25 percent , suggesting further measures to address underlying inflationary pressures on country’s economy.

In a two-month monetary policy announced on Monday, the bank feared that economic growth was expected to slow in Fiscal Year 19 but rise modestly in Fiscal Year 20.

“The monetary policy committee [of the SBP] noted that further policy measures are required to address underlying inflationary pressures from higher recent month-on-month headline and core inflation outturns, recent exchange rate depreciation, an elevated fiscal deficit and its increased monetisation, and potential adjustments in utility tariffs,” read an SBP statement.

Central Bank observed that the slowdown is mostly due to lower growth in agriculture and industry. More than two-thirds of real GDP growth in FY19 is expected to come from services.

“Going forward, some gradual recovery in economic activity is expected on the back of improved market sentiment in the context of the IMF supported programme,” added the statement.

Talking about the external front, the SBP policy report mentioned that the current account deficit narrowed to $9.6 billion in Jul-Mar FY19 as compared to a deficit of $13.6bn during the same period last year, a fall of 29pc.

“The reduction is mainly driven by import compression and a healthy growth in workers’ remittances. This impact was partially offset by higher international oil prices,” it added.

According to the policy report, the non-oil trade deficit declined from $13.7b in Jul-Mar FY18 to $11b in Jul-Mar FY19.

“Recent indicators suggest export volumes have begun to grow although total export receipts have not grown due to unfavorable prices.”

The statement added that foreign reserves declined to $8.8b as of May 10 from $10.5b at end-March 2019. “The exchange rate also came under pressure in the last few days. In SBP’s view, the recent movement in the exchange rate reflects the continuing resolution of accumulated imbalances of the past and some role of supply and demand factors.”

The SBP said that it will continue to closely monitor the situation and stands ready to take measures, as needed, to address any unwarranted volatility in the foreign exchange market.

The central bank said that the current level of foreign reserves was below standard adequacy levels and sufficient for only three months of imports cover.

The central bank said that the current level of foreign reserves was below standard adequacy levels and sufficient for only three months of imports cover.

The SBP report mentioned that the overall fiscal deficit was likely to be considerably higher during Jul-Mar FY19 as compared to the same period last year due to a shortfall in revenue collection, higher than budgeted interest payments and security related expenditures.

“From a monetary policy perspective, a growing portion of the fiscal deficit has been financed through borrowings from SBP. In absolute terms, the government borrowed Rs4.8 trillion from the central during Jul 1 to May 10 period of the FY19, which is 2.4 times the borrowing during the same period last year.”

A major portion of the borrowing from the SBP (Rs3.7tr) reflects a shift away from commercial banks which were reluctant to lend to the government at prevailing rates. The resulting increase in monetisation of the deficit has added to inflationary pressures.

The report mentioned that the consumer price index (CPI) rose by 9.4pc in March and 8.8pc in April, on a year-on-year basis. Average headline CPI inflation reached 7pc in Jul-Apr FY19 compared to 3.8pc in the same period last year.

It added that the annualised headline month-on-month inflation has risen considerably in the last three months due to the recent hike in domestic fuel prices and rising food prices and input costs.